Axis AMC submits internal probe report to Sebi; says conduct of individuals has no impact on liquidity

The fund house said, "Based on the findings so far, we believe that the conduct of concerned individuals identified do not have any impact on our liquidity or our operations. Any misconduct by the individuals concerned was outside of and in contravention of our policies and procedures and the training they had received.”

Axis Mutual Fund front-running case: Axis AMC submits internal probe report to SEBI

New Delhi: In connection with the alleged wrongdoings by two of its officials - Viresh Joshi and Deepak Agrawal - Axis Mutual Fund on Tuesday submitted its internal probe report to market regulator Securities and Exchange Board of India (Sebi).

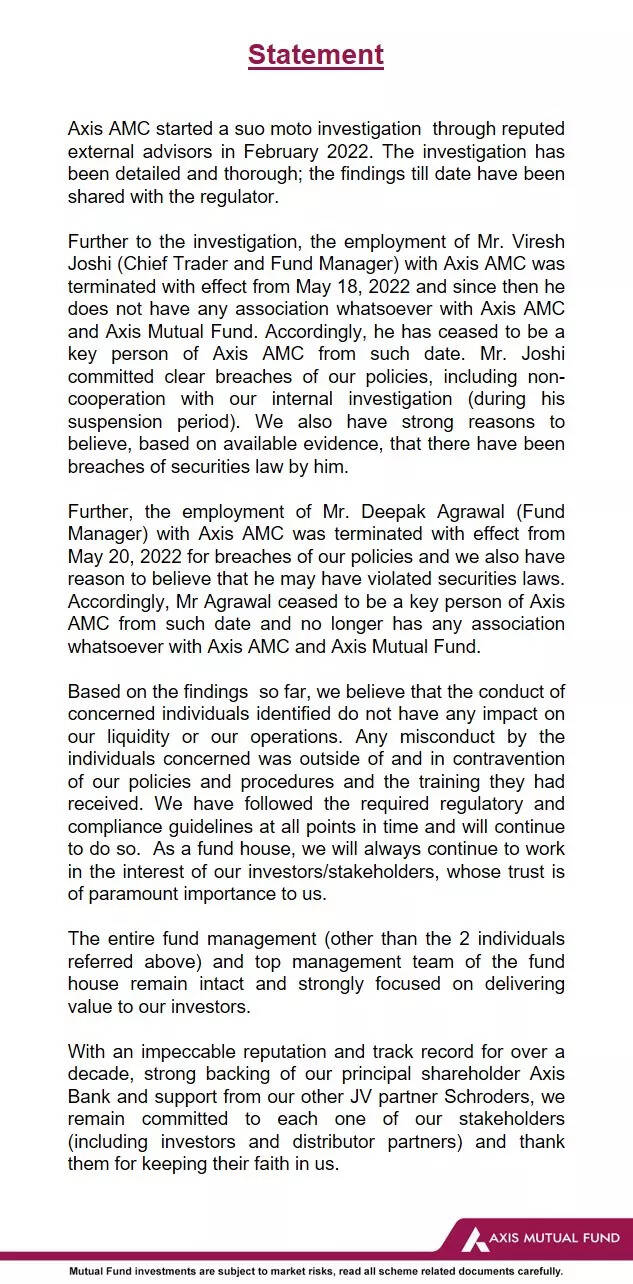

Axis AMC started a suo moto investigation through reputed external advisors in February 2022. The investigation has been detailed and thorough; the findings till date have been shared with the regulator, it said in a statement.

Joshi, who was an ex-fund manager and chief dealer at Axis Mutual Fund, “committed clear breaches of our policies, including non-cooperation with our internal investigation (during his suspension period).” The fund house stated that, “We also have strong reasons to believe, based on available evidence, that there have been breaches of securities law by him.”

Further, the employment of Agrawal (Fund Manager) with Axis AMC was terminated with effect from May 20, 2022 for breaches of our policies and we also have reason to believe that he may have violated securities laws, Axis MF added.

According to Axis MF, there are strong reasons to believe, based on available evidence, that Joshi had breached securities law. And also, reason to believe that Agrawal may have also violated securities laws.

"Based on the findings so far, we believe that the conduct of concerned individuals identified do not have any impact on our liquidity or our operations. Any misconduct by the individuals concerned was outside of and in contravention of our policies and procedures and the training they had received,” the fund house noted.

It added following the required regulatory and compliance guidelines at all points in time and will continue to do so. As a fund house, we will always continue to work in the interest of our investors/stakeholders, whose trust is of paramount importance to us.

The entire fund management (other than the 2 individuals referred above) and top management team of the fund house remain intact and strongly focused on delivering value to our investors.

Axis Mutual Fund is the country’s seventh largest mutual fund house with assets worth Rs 1.96 trillion.

Trending:

End of Article

Subscribe to our daily Newsletter!

Related News

NSE Announces Derivative Contracts on Nifty Next 50 Index, Fixes Date for April Launch

Getting BSE Stock Recommendations? BIG Update for Investors, Traders

A Comprehensive Guide to Income Tax Return Filing for FY 23-24: Form Issue Dates, ITR Forms, and More

Vodafone Idea FPO GMP: Check Latest Grey Market Premium, Subscription Status, Key Dates And Step-By-Step Guide To Apply

IREDA Share Price Target 2024: Rocket Share Q4 2024 Quarterly Results This Week; BUY PSU Stock?