SBI, PNB Bank, ICICI Bank: Latest FD rates for senior citizens compared

FDs offer a variety of interest pay-out terms such as monthly, quarterly, half-yearly and annual, making the product highly customised to investors’ needs. Also, an investment in the debt instrument is relatively flexible as it offers maturity periods ranging from 1 week to 10 years. Here is a comparison of FD rates given by 3 major bank brands.

FD

Most banks offer higher fixed deposit (FD) interest rates to senior citizens as compared to returns given to other demographics in order to corner the maximum share of the lucrative senior citizen FD market. Seniors prefer the relative safety of FDs and tend to park a life-time worth of savings in a trusted bank.

In the wake of interest rate revisions by banks post RBI rate hikes, FDs have once again become lucrative with higher rates and a real positive return after accounting for inflation.

Fixed deposits offer a variety of interest pay-out terms such as monthly, quarterly, half-yearly and annual, making the product highly customised to investors’ needs. Also, an investment in the debt instrument is relatively flexible as it offers maturity periods ranging from 1 week to 10 years.

While there are plenty of obscure private lenders that offer higher FD rates than the industry average, they do not evoke a sense of trust among the average FD investors, who would give up higher returns for the sake of safety.

Investors tend to trust major well-established banks when comes to parking their life-long savings. In this regard, here is a comparison of FD rates given by 3 major bank brands in the market.

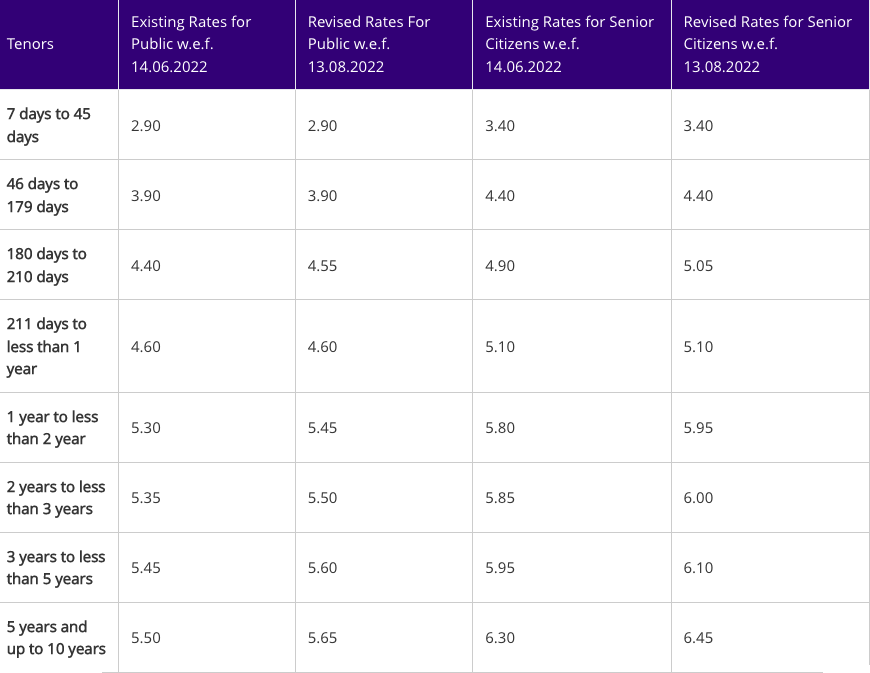

State Bank of India latest FD rates

India’s biggest bank State Bank of India revised interest rates on retail domestic term deposits (below Rs 2 crore) with effect from August 12, 2022.

SBI Bank also introduced tenor of 1000 days at 6.10 % rate with effect from August 15, 2022 for 75 days.

A special ‘SBI Wecare’ Deposit for Senior Citizens was introduced in which an additional premium of 30 bps (over & above the existing 50 bps as detailed in the table) will be paid to Senior Citizen’s on their retail TD for '5 Years and above' tenor only.

"SBI Wecare” deposit scheme stands extended up to March 31, 2023. The interest rate payable to SBI Staff and SBI pensioners will be 1.00% above the applicable rate.

The rate applicable to all Senior Citizens and SBI Pensioners of age 60 years and above will be 0.50% above the rate payable for all tenors to resident Indian senior citizens i.e. SBI resident Indian Senior Citizen Pensioners will get both the benefits of Staff (1%) and resident Indian Senior Citizens (0.50%). The proposed rates of interest shall be made applicable to fresh deposits and renewals of maturing deposits, as per SBI website.

The interest rates on “SBI Tax Savings Scheme 2006(SBITSS)” Retail Deposits and NRO deposits shall be aligned as per the proposed rates for domestic retail term deposits. However, NRO deposits of Staff are not eligible for additional 1% interest otherwise applicable to staff domestic retail deposits, these rates of interest shall also be made applicable to domestic term deposits from Cooperative Banks.

Punjab National Bank (PNB) FD rates For Senior Citizens

Senior citizens of age 60 years and up to 80 years shall get an additional rate of interest of 50 basis points (1%=100 basis points) over applicable card rates for a period up to 5 years and 80 basis points for a period above 5 years on domestic deposits of less than Rs 2 Crore, says the bank’s website.

In case of staff members as well as retired staff members who are also Senior Citizens, maximum rate of interest to be allowed over applicable card rate shall be 150 bps for a period upto 5 years and 180 basis points for period above 5 years.

Further, Super Senior Citizens of age above 80 years shall get additional rate of interest of 80bps over applicable card rate across all maturity buckets.

In case of staff members as well as retired staff members who are also Super Senior Citizens, maximum rate of interest to be allowed over applicable card rate shall be 180 bps over applicable card rate across all maturity buckets. In case of PNB Tax Saver Fixed deposit scheme, staff members as well as retired staff members who are also Senior Citizens, maximum rate of interest to be allowed over applicable card rate is 100 bps.

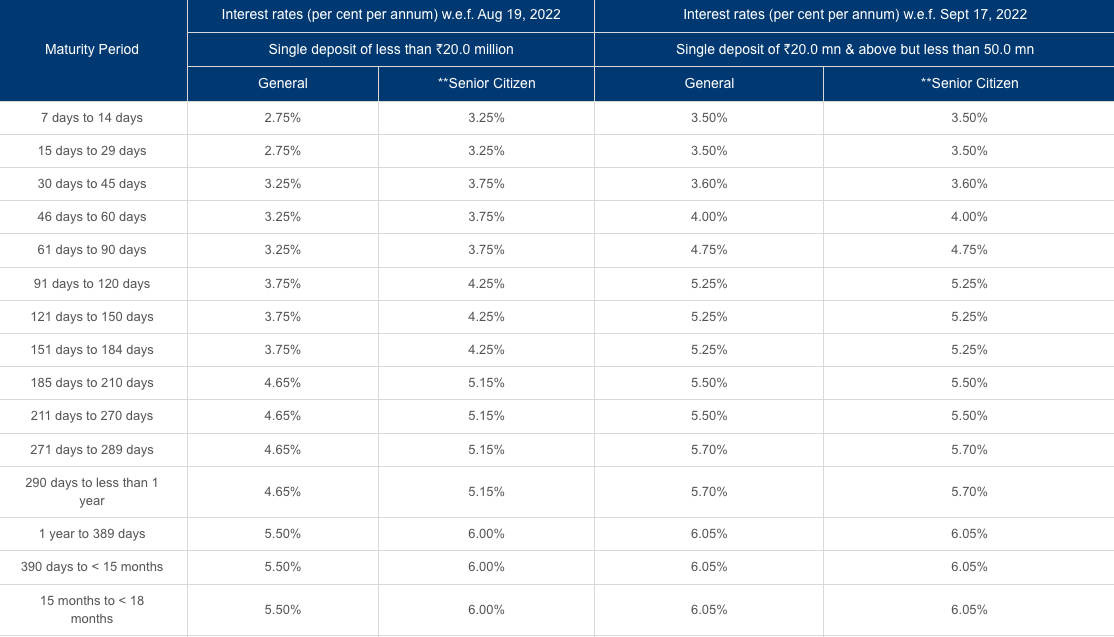

ICICI Bank latest FD rates for senior citizens

ICICI Bank offers interest rates as high as 6.60% p.a. for Senior Citizens (above the age of 60 years) and up to 6.10% p.a. for citizens below age of years. ICICI Bank FD is one of the safest FDs and rated as ‘AAA’, the safest investment grade.

Under ICICI Bank’s Golden Years FD scheme, resident Senior Citizen get an additional interest rate on an FD of 0.20% for a limited time over and above the existing additional rate of 0.50% per annum. In case a Fixed Deposit is opened and the above scheme is prematurely withdrawn/closed after, on or after 5 years 1 day, the applicable penal rate will be 1.20%. In case the deposit opened in the above scheme is prematurely withdrawn/closed before 5 years 1 day, the prevailing premature withdrawal policy will be applicable.

Trending:

End of Article

Subscribe to our daily Newsletter!

Related News

NSE Announces Derivative Contracts on Nifty Next 50 Index, Fixes Date for April Launch

Getting BSE Stock Recommendations? BIG Update for Investors, Traders

A Comprehensive Guide to Income Tax Return Filing for FY 23-24: Form Issue Dates, ITR Forms, and More

Vodafone Idea FPO GMP: Check Latest Grey Market Premium, Subscription Status, Key Dates And Step-By-Step Guide To Apply

IREDA Share Price Target 2024: Rocket Share Q4 2024 Quarterly Results This Week; BUY PSU Stock?