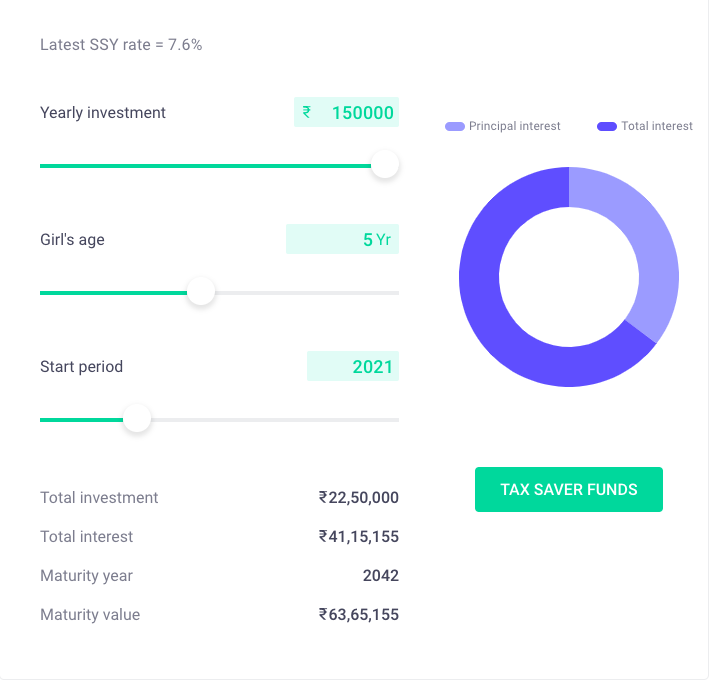

Sukanya Samriddhi Yojana calculator: How monthly investment of Rs 12,500 can turn into Rs 64 lakh in few years

An annual investment of up to Rs 1.5 lakh can be made in one SSY account. The investor may claim tax exemption on the entire Rs 1.5 lakh investment under Section 80C of the I-T Act, 1961. The interest rate for the second quarter of the current Financial Year 2022-23 (FY23) is an inflation-beating 7.6%.

Sukanya Samriddhi Yojana calculator: How monthly investment of Rs 12,500 can turn into Rs 64 lakh in few years

Sukanya Samriddhi Yojana (SSY) is a popular and risk-free investment option for parents with daughters. The SSY, launched in 2015 under the government’s ‘Beti Bachao Beti Padhao’ campaign, aims to encourage parents to save for their daughter’s education and upbringing. The SSY offers safe and assured returns, 100% tax-free interest, and tax deductions under Section 80C of the I-T Act.

The Sukanya Samriddhi scheme is a government-backed small savings scheme that can be opened in post offices or at designated public and private sector banks. It is among the most rewarding investment options in the fixed income category.

Parents of girl child aged 10 can open an SSY account under their child’s name. Maximum two accounts can be opened in case of multiple daughters, with a limit of one account per daughter. The account matures after 21 years of the date of opening of the account or on the marriage of the account holder after she turns 18, whichever is earlier.

An annual investment of up to Rs 1.5 lakh can be made in one SSY account. The investor may claim tax exemption on the entire Rs 1.5 lakh investment under Section 80C of the I-T Act, 1961. The interest rate for the second quarter of the current Financial Year 2022-23 (FY23) is an inflation-beating 7.6%.

Based on the current interest rate, the Sukanya Samriddhi Yojana calculator shows that an investment of Rs 12,500 per month would turn into Rs 64 lakh by the time of maturity, which is 21 years from the date of opening of the account. However, it is to be noted that no withdrawals should be made during the investment period.

Trending:

End of Article

Subscribe to our daily Newsletter!

Related News

Amid Floods, Air India Suspends All Flights To Dubai Due To 'Operational Disruptions'

Varyaa Creations IPO GMP: Check Price Band, Key Dates, And Other Details

IREDA Q4 Results 2024: Company Achieves Record-Breaking Profit, PAT Surges By 44.83 pc In FY 2023-24

Wipro Q4 Results: IT Major's Profit Declines 8 pc to Rs 2,835 crore

Hindustan Zinc Q4 Results: Vedanta Group Firm Reports 21 pc YOY Drop in Net Profit